Sinking funds. Why you need at least one and how to do it.

Ever find yourself whispering to your partner, “How the hell can they afford that?” or wondering what you’re doing wrong when someone redoes their entire kitchen out of nowhere?

You’re not alone. We all assume everyone has more money than us. And sure, some people do. But that doesn’t mean they’re actually good with money.

Here’s the thing: being smart with your money—not flashy—takes a huge load off. And that’s where sinking funds come in.

We started setting money aside for the stuff we knew was coming eventually: a new roof, a dead appliance, surprise plumbing issues. Not exactly fun—but way less stressful than scrambling when those things hit.

It’s not magic or mystery. It’s just planning. And once the essentials are covered, it frees you up to say yes to the fun stuff, too.

Did you know you can also estimate how long you have until something in your home needs replaced?

Congrats, you just bought the most expensive thing you’ve ever owned—and now you get to start worrying about when it’ll break. Fun, right? Try to get a record of when things were last replaced so you can plan ahead instead of being blindsided by a dying water heater six months in.

So… How Do You Pay for Home Renovations?

If you're anything like me, you’ve probably looked around your house and thought: “How the hell do people afford this?” Short answer? Most people turn to their bank. Long answer? It’s a little more complicated. (And I am not a financial advisor—talk to a real one before making big money moves. This is just what we’ve done.)

Let’s Start With the Basics:

You can take out a home equity loan or line of credit… if you have equity. That means your home needs to be worth more than what you owe on your mortgage.

Just bought a house with 3% down? Congrats—you probably have $17 in equity and a dream. So… maybe don’t plan that $80K kitchen reno just yet.

And before you go taking out more loans—remember, borrowing against your house is basically a second mortgage. Sure, you might not pay interest for a while, but that bill will come due. And if the payment hits the same month you get laid off? Well, that’s a panic attack waiting to happen.

Enter: The Sinking Fund

Let’s talk about the non-panic option.

If you’ve got an emergency fund but never actually want to use it (hi, it’s me), a sinking fund can be your new BFF. Because there’s a difference between a surprise expense… and a predictable one you just hoped wouldn’t happen yet.

So What Is a Sinking Fund?

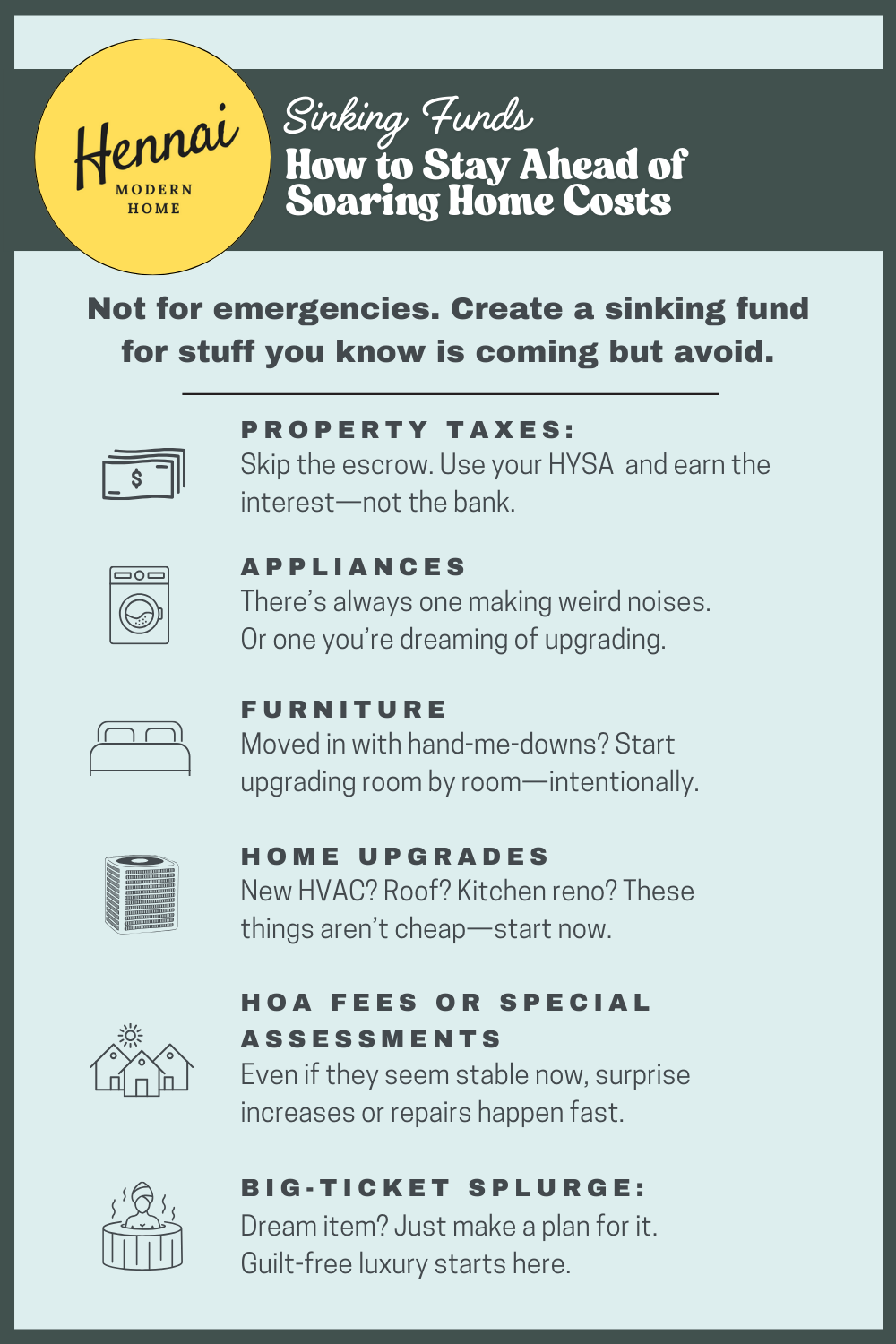

A sinking fund is just a savings account with a purpose. It’s for things you know are coming—like a new roof, taxes, or that “fun” day your fridge dies. It is not your emergency fund. (Different drama.)

How Does It Work?

Easy math: Take the amount you’ll need → divide by the number of months you have → save that amount every month in a high-yield savings account. Now, when the expense hits? You’re smugly prepared and guilt-free.

Why I Love Sinking Funds (and Why You Should Too)

Our first sinking fund was for our down payment—we just didn’t know to call it that. We picked a number, automated deposits, and celebrated when we hit our goal.

Then reality hit: every house we could afford needed major renovations. So we dropped our budget by 20%, broadened our search, and kept that extra cash for upgrades. (Our real estate agent was thrilled, obviously.)

Fast forward to homeownership: We’ve got a 15-year-old roof. Our estimate? $20K. If we save $166/month for 10 years, we’ll be ready when it gives out—with zero panic and zero debt. Way better than, “Holy sh*t, where do we get $20K?!”

Not Just for Homeowners

You can use sinking funds to:

Offset future childcare costs

Save for a sabbatical

Fund that vacation without post-trip credit card shame

Prep for literally anything you know is coming

How Many Sinking Funds Should You Have?

Ask yourself: What’s the biggest amount you could spend without messing up your day-to-day life? If $500 is fine, but $1,000 would have you sweating? That’s your threshold. Anything above it deserves its own sinking fund.

Where to Start

If the monthly totals make you want to crawl under the bed, don’t worry. Start small. One or two categories.

Good starter funds:

Property taxes (because paying them with a credit card is a 3% fee and a bad time)

Big annual bills

Known replacements (appliances, roof, car, etc.)

Got a bonus? Sure, buy the purse. Or, be that person who finds financial security thrilling. I’m her. I live for it. Treats come after the spreadsheet tells me it’s cool.

Where to Keep Your Sinking Funds

Look for a high-yield savings account with a setup that makes sense for you. Online banks usually offer the best interest rates. We use a credit union with multiple named sub-accounts—it’s simple, clear, and satisfying. (No, seriously. Seeing “Vacation Fund” hit its target? 10/10 feeling.)