Stop F*cking Around and Look at Your Finances

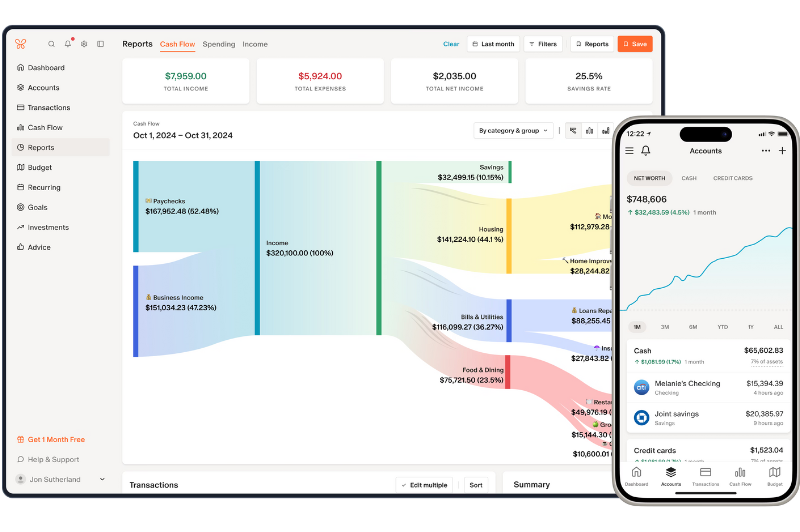

*Not my accounts, this is from the Monarch website (frankly, I wish the example wasn’t someone making $320K…)

Quick FYI: I’m not a financial advisor—this is just me sharing what actually works for my money brain. Some links below are affiliate links, which means I might earn a commission if you sign up (at no extra cost to you). Everything here is stuff I personally use and love.

I’m gonna be real with you: I actually like managing money. I’ve been that nerd with Google Sheets for years, happily color-coding categories and tracking every dollar. Part of that is my Leo energy (we’re famously good with money), but part of it was also me refusing to pay for an app to tell me what my spreadsheet already could.

The problem? Every other app I tried—YNAB, Mint, you name it—was either way too much work to set up or didn’t show me anything special. Monarch is the first one that made me think, “This is actually worth it.”

Costco Chaos, But Make It Budget-Friendly

Let’s talk about Costco. In general shout out for my love of Costco, I will never shame Costco, but it is easy to go a little ham in there. You go in for toilet paper and walk out with:

New fluffy towels

40 pound bag of rice

Collagen powder and Crest White Strips

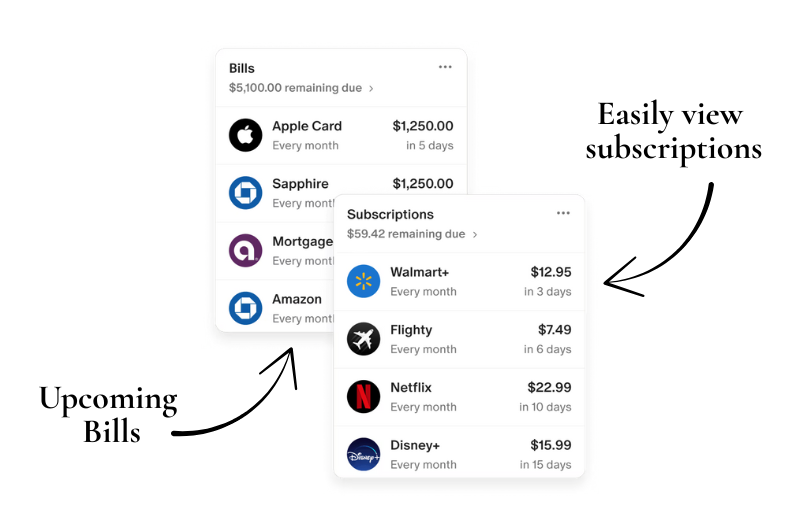

Every other app dumps all that into “Groceries.” Monarch? You can split it. Part “groceries”, part “Household,” part “self care.” Suddenly, your budget isn’t lying to you, it actually reflects real life.

The Charts That Keep Me Coming Back

This is my favorite part: Monarch shows me how we’re pacing this month compared to last. No vague vibes, no “I think we’re fine.” Just hard data in a pretty chart.

Spending less than last month? Phew, take a deep breath (don’t treat yourself with retail therapy).

Blowing through takeout money by week two? Reality check.

It’s not about guilt—it’s about seeing the truth so you can do better next month (or next week).

Your Accidental Raise Is Waiting

Here’s the thing: you might not need a raise or a new job. You might just need to stop letting your money disappear without noticing.

Knowing exactly where your money goes = you giving yourself a raise. No corporate ladder-climbing required.

Managing Money for Couples

If you’re in a relationship, money can get messy—because let’s be real, you were raised differently and probably don’t see money the same way. That’s normal. But it also means you need a full picture of what’s coming in and going out. Pull your separate and joint accounts into one view so you actually know how you spend as a household—no matter who’s swiping the card. You can tag your partner to review transactions (because “what did you buy at Costco?” doesn’t need to be a weekly fight), and the monthly summary makes check-ins quick instead of painful. The point isn’t to nickel-and-dime each other, it’s to create a budget that actually supports both of you and leaves room for the things you each care about.

The Easiest Way I’ve Ever Saved More Without Earning More

Most people aren’t “bad with money”, they’re just not paying attention. Monarch makes paying attention stupidly easy. Split categories. Track progress. Feel in control instead of overwhelmed. Trust me, I know it feels scary to know the truth, but you won't be scared if you actually have a plan.

I’ve tried every free trial and every spreadsheet template. Monarch is the one that stuck. It’s easy, it’s actually accurate, and the charts are so useful!

Get clarity, give yourself a financial reset, and maybe even breathe a little easier. Use this link to snag 50% off your first year with Monarch. $50 is worth every penny once you see where your cash has been going.